Majority of Consumers are Skeptical of Cryptocurrencies, but Younger Populations are More Enthusiastic

- August 8, 2022

- 4 min

Getwizer’s research, in association with Variety VIP+, reveals cryptocurrencies face difficulties in becoming truly accepted by all consumers

With Bitcoin and Ethereum falling sharply in value, after peaking late last year, and cryptocurrencies face a tough challenge to rehabilitate their image and accessibility for the general public if they are to survive and ever go mainstream.

It has been a nightmare year for Cryptocurrencies. In November last year, Bitcoin had surged to an all-time high of $68,789, only to fall to below $20,000 in June of this year. The sharp fall in prices caused the collapse of Terra, one of the sector’s largest stablecoins, and saw a number of key crypto hedge funds collapse, such as Three Arrows Capital and Celsius.

During July Bitcoin improved slightly to reach almost $25,000, but showed little sign of seeing a full recovery in value any time soon. Some analysts speculated that the past six months were just a correction in the market value of this volatile asset and others were even recommending investing in Bitcoin as the threat of a recession looms. However, with Elon Musk selling off most of his Bitcoin holdings, the future of cryptocurrencies is still far from certain.

Majority of Consumers Remain Unsure of Cryptocurrencies

The majority of people remain uncertain when it comes to the likes of Bitcoin, according to the latest Variety VIP+ Media and Tech Attitudes survey powered by Getwizer. When respondents were asked if they thought cryptocurrencies were a scam or ponzi scheme, 33.6% said “yes”, 36.1% said, “I don’t know”, while 30.3% replied “no”.

The research, however, shows that younger respondents are more positive. Both the 15-29 and 30-44 year-old categories saw 38.4% disagreeing that cryptocurrencies are a scam or ponzi scheme, compared to only 20.4% of those over 60.

Ethnicity also plays a role when it comes to confidence in crypto. Caucasin people are most skeptical, with only almost 35% believing these new currencies are a con. This drops to just below 28% for African American respondents.

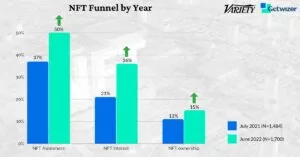

How many people own cryptocurrencies?

While Bitcoin and its counterparts command significant coverage in the media, only a small number of respondents actually claim to own cryptocurrencies (8.8%) with even less saying they know a lot about them (8.3%). Most people say they have heard about them (44.5%), but know little about crypto. The younger the respondent, however, the more likely they understood more about cryptocurrencies and owned them (see chart below).

Amongst entnic groups, Hispanics were not only more likely to own cryptocurrencies (15.3%), with African Americans in second place, with 13.1% owning crypto. Caucasins display the least enthusiasm with only 7% claiming ownership.

Will Bitcoin Ever Become Mainstream?

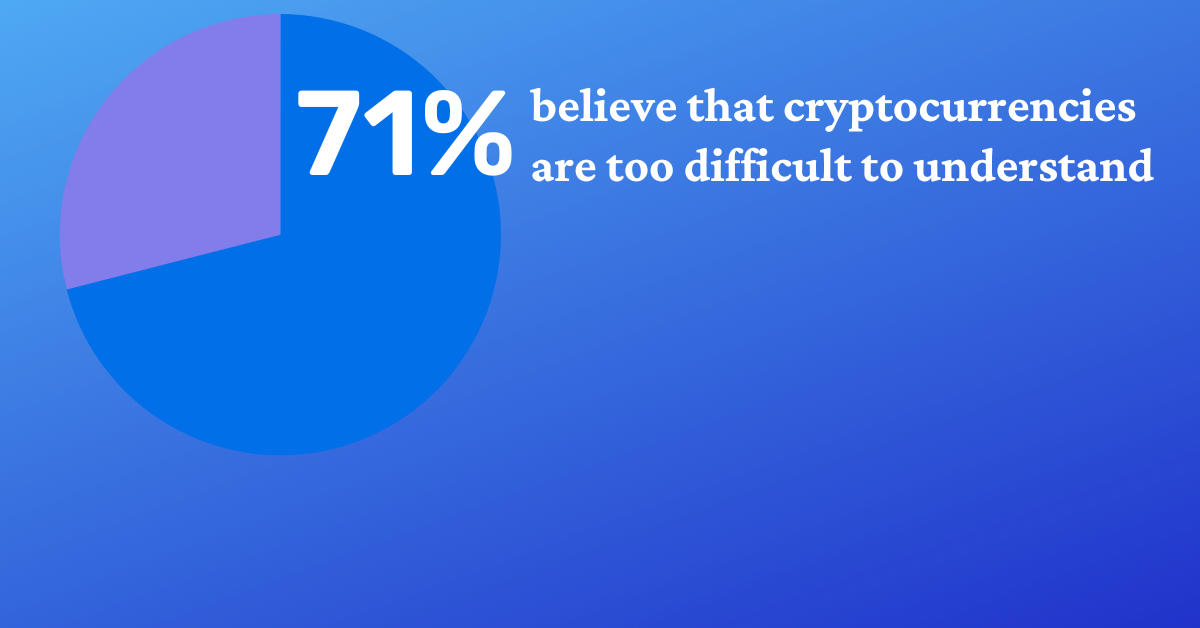

The research also revealed a significant barrier to the wider adoption of cryptocurrencies in the near future. A staggering 71% of respondents agreed that “cryptocurrencies are too difficult for the average person to understand and use.”

The majority of younger age groups shared the same sentiment when it came to cryptocurrencies (see chart below) as well as 73% of 45-59 year-olds and

83% of overs 60s.

Need For Education and Brand Development

While the research points to a small number of consumers seeing value in cryptocurrencies as a legitimate non-risky investment alternative, the majority (70%) feel they are highly risky. This underlines that for such currencies to prosper over the medium-to-long term a significant investment will be needed in marketing and education, to bring these digital currencies into the mainstream and help customers understand and balance the associated risk.

This may not necessarily be that far away, with a group of bipartisan senators looking to place the Commodity Futures Trading Commission (CFTC) as the regulatory body tasked with overseeing Bitcoin and Ethereum. Such regulatory oversight will help build consumer trust and should see more educational knowledge develop around the sector to better inform consumers. For the future of these currencies, this could prove to be the right step, in the right direction.

Get started

You too can test anything, anytime, over and over again.

We'll be in touch soon. Privacy settings