When brands are looking to get to grips with consumer behavior and perceptions, quantitative research is their go-to solution. But quant research often fails to capture the 'why' behind consumer ...

Share the wisdom

-

Talking research Agile Qual Solutions: Bringing Numbers to Life and Delivering Affordable Insights to Research Data 4 min -

Talking research Demand for Getwizer’s Insights Reports Increases by 125% To Help Transform Research into Actionable Insights - By Getwizer Team 4 minHarnessing the power of research data and transforming it into actionable insights can be a formidable challenge. That's where Getwizer steps in with its groundbreaking insights capabilities ...

-

Talking research 2022: The Year Market Research Became Faster, More Insightful and Even More Cost Effective - By Getwizer Team 5 minDriven by innovation, Getwizer has been constantly evolving, adding new features and enhancing others, to keep ahead of the fast paced requirements needed to keep track of the rapid changes in ...

-

Talking research Focus on Natural Beauty Driving Growth in Skincare Sector - By Jody Kleinman 5 minSales of skincare products are on the rise, particularly among Gen Z and men, according to Getwizer research.

-

News & PR PRESS RELEASE: Gambling and Gaming Habits Are Dictated by Your Gender and Generation - By Getwizer team 4 minNEW YORK, 28 September 2022 — Research conducted by Getwizer, the hybrid consumer insights platform, has found that almost 46% of American men but only just over 25% of women have placed a bet on ...

-

Talking research How Getwizer Ensures the Highest Levels of Data Quality With Its Unique Three-Layered Approach - By Shira Watermann 3 minEnsuring data quality has become an ever greater concern as market researchers grapple with the need to distinguish between genuine consumer responses and automated or fraudulent inputs. Identifying ... -

Talking research Agile Qual Solutions: Bringing Numbers to Life and Delivering Affordable Insights to Research ... - By Hilary Jones 4 minWhen brands are looking to get to grips with consumer behavior and perceptions, quantitative research is their go-to solution. But quant research often fails to capture the 'why' behind consumer ... -

Talking research Getwizer Announces Appointment of Veteran Insights Expert Bruce Friend as CEO to Drive Growth - By Getwizer Team 2 minGetwizer, the hybrid consumer insights platform, announced today the appointment of industry veteran Bruce Friend as its new CEO. Bruce is an industry-leading media and marketing insights executive ... -

Talking research Demand for Getwizer’s Insights Reports Increases by 125% To Help Transform Research into ... - By Getwizer Team 4 minHarnessing the power of research data and transforming it into actionable insights can be a formidable challenge. That's where Getwizer steps in with its groundbreaking insights capabilities ... -

Talking research Getwizer’s Dream Team Gets Stronger - By Getwizer Team 6 minAt the heart of Getwizer is a unique hybrid approach that integrates the very best of tech with the very best human expertise available to deliver a custom, quick and ...

-

Talking research 2022: The Year Market Research Became Faster, More Insightful and Even More Cost Effective - By Getwizer Team 5 minDriven by innovation, Getwizer has been constantly evolving, adding new features and enhancing others, to keep ahead of the fast paced requirements needed to keep track of the rapid changes in ... -

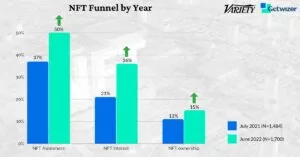

Talking research PRESS RELEASE: NFTs Failing to Gain Traction With Consumers, But Brands Should Remain Hopeful - By Getwizer team 3 minThe popularity of NFTs (Non-Fungible Tokens) remains limited with just under 11% saying they actually own one or more, according to research conducted by Getwizer, the hybrid consumer insights ... -

Talking research Building Consumer Awareness is Key for NFT Success - By Alex Frankel Schorr 5 minNFTs offer brands multiple avenues to deliver value, but they will need to tackle the relatively low-levels of knowledge among consumers, according to Getwizer’s research. -

Talking research PRESS RELEASE: Gas Prices and Extra Expenses Are Top Vacation Travel Concerns, Getwizer ... - By Getwizer team 3 minWith the winter holiday season about to kick off, over 70% of Americans have already taken a vacation during the summer of 2022, according to research conducted by Getwizer, the hybrid consumer ... -

Talking research Focus on Natural Beauty Driving Growth in Skincare Sector - By Jody Kleinman 5 minSales of skincare products are on the rise, particularly among Gen Z and men, according to Getwizer research. -

Talking tech Getwizer’s New Features Deliver Even Faster Research - By Hilary Jones 2 minThree new additions to Getwizer’s hybrid consumer insights platform now enable an even quicker, more flexible and repeatable research process. Users can instantly duplicate individual elements of ... -

News & PR PRESS RELEASE: Gambling and Gaming Habits Are Dictated by Your Gender and Generation - By Getwizer team 4 minNEW YORK, 28 September 2022 — Research conducted by Getwizer, the hybrid consumer insights platform, has found that almost 46% of American men but only just over 25% of women have placed a bet on ...

Get started

You too can test anything, anytime, over and over again.

We'll be in touch soon. Privacy settings